ROYAL DECREE-LAW 35/2020, OF DECEMBER 22, ON URGENT MEASURES TO SUPPORT THE TOURIST SECTOR, HOSPITALITY AND TRADE AND IN TAX MATTERS.

Article 9. Reduction in 2020 of the net income calculated by the objective estimation method in the Personal Income Tax and of the quota accrued by current operations of the simplified regime of the Value Added Tax.

1. The reduction provided for in the first additional provision of Order HAC / 1164/2019, of November 22, by which the objective estimation method of Personal Income Tax and the special regime are developed for 2020 Simplified Value Added Tax will be:

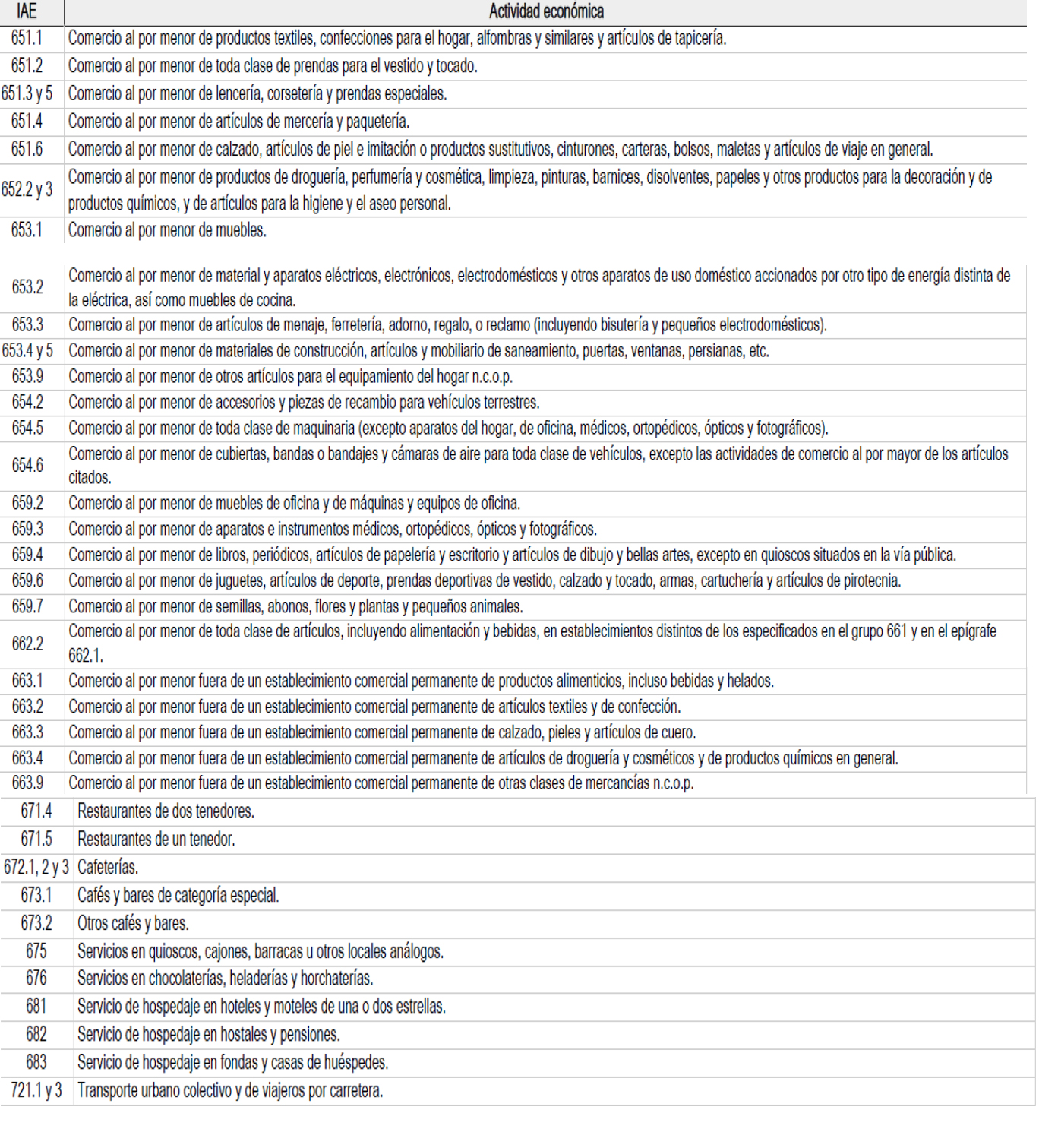

a) 20% for the following activities:

b) 35 percent, for the following activities:

2. The amount of the reduction provided for in section 1 above will be taken into account to quantify the net income for the purposes of the fourth installment payment corresponding to the year 2020.

3. For the calculation of the first installment payment corresponding to the year 2021, the reduction foreseen in the first additional provision of Order HAC / 1155/2020, of November 25, by which the objective estimation method is developed for the year 2021 of the Personal Income Tax and the special simplified regime of the Value Added Tax, will be the one provided for in section 1 above.

4. The taxpayers of the Value Added Tax that carry out business or professional activities included in Annex II of Order HAC / 1164/2019, of November 22, and are covered by the simplified special regime, for the purposes of calculating the annual quota of the aforementioned special regime, may reduce the amount of quotas accrued for current operations corresponding to such activities in said year by 20 percent.

However, said reduction will be 35 percent for the following activities:

5. The businessmen and professionals referred to in section 4 above may reduce by 20 or 35 percent the percentages indicated in number 3 of the Instructions for the application of the indices and modules in the Value Added Tax of Annex II of Order HAC / 1155/2020, of November 25, for the calculation of the payment on account corresponding to the first quarterly installment of fiscal year 2021.

Article 11. Incidence of the states of alarm decreed in 2020 in the determination of the

annual yield according to the objective estimation method of income tax

Individuals and in the calculation of the accrued fee for current operations of the special regime

Simplified Value Added Tax in said period.

1. For the purposes set forth in number 7 of the Instructions for the application of signs, indices or modules in Personal Income Tax and numbers 8 and 9 of the Instructions for the application of indices and modules In the Value Added Tax of Annex II of Order HAC / 1164/2019, of November 22, the days in which the activity was declared shall not be counted, in any case, as the period in which the activity was carried out. state of alarm in the first semester of 2020, as well as the days of the second semester of 2020 in which, whether the state of alarm was declared or not, the effective exercise of economic activity would have been suspended as a result of the measures adopted by the competent authority to correct the evolution of the epidemiological situation derived from SARS-CoV-2.

In particular, for the quantification of the modules "salaried personnel", "non-salaried personnel" and "employed personnel", as the case may be, those corresponding to the days referred to in the preceding paragraph will not be counted as hours worked and for In the quantification of the "distance traveled" and "electrical energy consumption" modules, the kilometers traveled and the kilowatt hours that proportionally correspond to the days referred to in the first paragraph will not be computed.