EXTENSION OF THE RECORDS OF TEMPORARY EMPLOYMENT REGULATION BASED ON THE CAUSES COLLECTED IN ARTICLE 22 OF ROYAL DECREE-LAW 8/2020, OF MARCH 17, OF EXTRAORDINARY URGENT MEASURES TO TACKLE THE ECONOMIC AND SOCIAL IMPACT OF COVID-19.

Article 1. Current temporary employment regulation files, based on article 22 of Royal Decree-Law 8/2020, of March 17, will be automatically extended until January 31, 2021.

First additional provision. Companies belonging to sectors with a high coverage rate due to temporary employment regulation files and a low activity recovery rate.

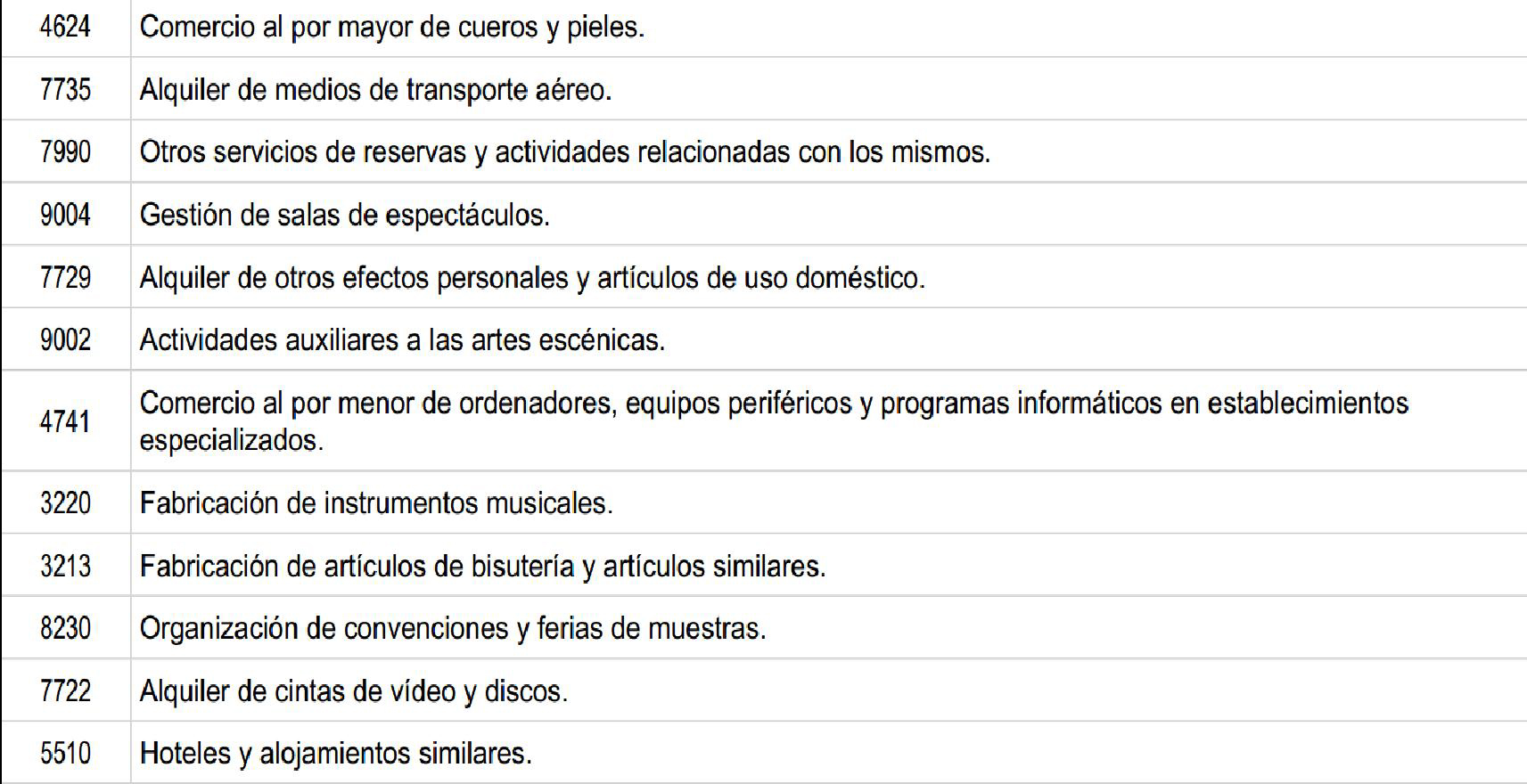

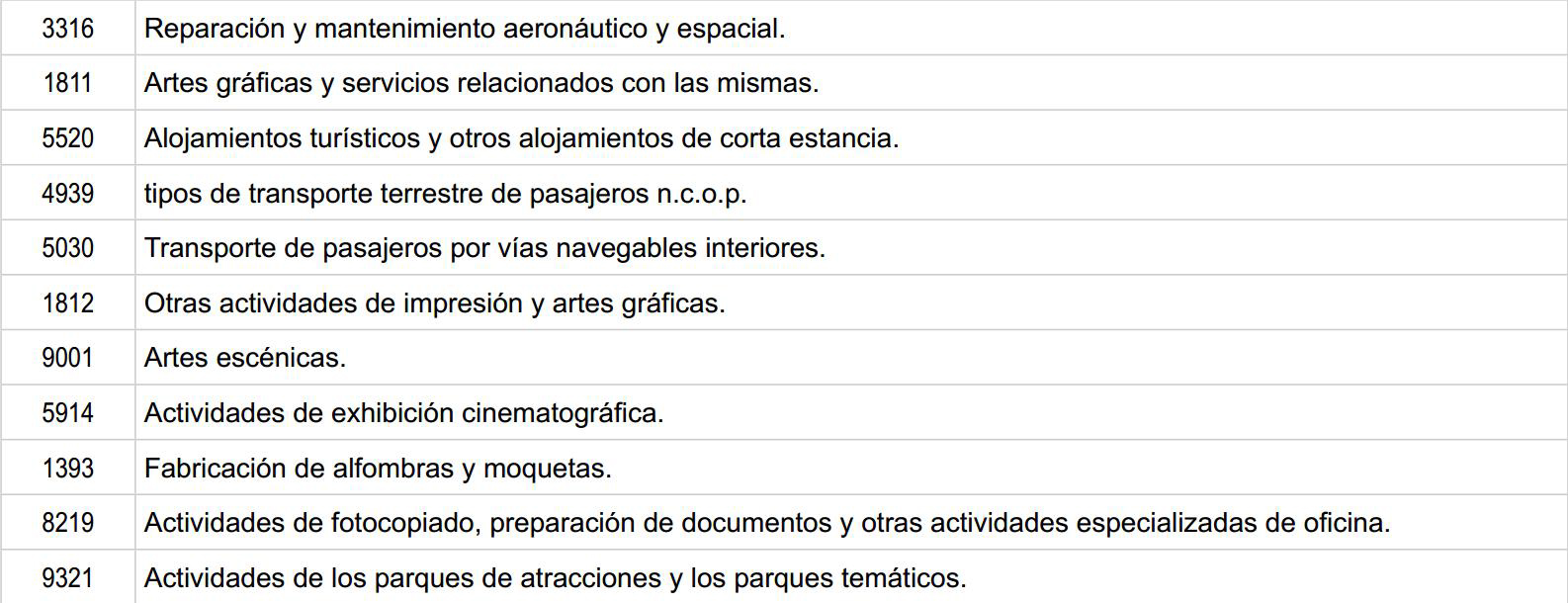

Companies belonging to sectors with a high coverage rate and a reduced activity recovery rate are considered to be those that have temporary employment regulation files automatically extended until January 31, 2021, in accordance with the provisions of Article 1, and whose activity is classified in one of the codes of the National Classification of Economic Activities –CNAE- 09– provided for in the Annex of this standard at the time of its entry into force.

Companies that have temporary employment regulation files automatically extended until January 31, 2021, in accordance with the provisions of article 1, whose business depends on, may also access the exemptions provided for in the third section of this additional provision, indirectly and mostly, from the companies referred to in the previous section, or that are part of their value chain, in the terms established below.

It will be understood that they are members of the value chain or indirectly dependent on the companies referred to in section 1, the companies whose turnover, during 2019, has been generated, at least, by fifty percent, in operations carried out. directly with those included in any of the CNAE-09 codes referred to in the indicated annex.

The application for declaration of a dependent company or member of the value chain must be submitted between October 5 and 19, 2020 and will be processed and resolved in accordance with the following procedure:

a) The procedure will begin by request of the company before the labor authority that had issued the express or tacit resolution of the file of temporary regulation of extended employment, which will be accompanied by a report or explanatory memory of the concurrence, within the scope of said file, of the circumstances set forth in the second paragraph of this section and, where appropriate, of the corresponding supporting documentation. The company must communicate its request to the workers and forward the previous report and the supporting documentation, if any, to their representation.

b) The resolution of the labor authority will be issued within a period of five days from the presentation of the application, upon request for a report from the Labor and Social Security Inspection, and must be limited to verifying the status of a company that is part of the value chain or indirectly dependent, in the terms defined by this additional provision.

After this period has elapsed without an express resolution having fallen, and without prejudice to the obligation to issue a resolution in accordance with the administrative procedure regulations, the company may understand the request submitted by administrative silence as estimated.

c) The report of the Labor and Social Security Inspection will be issued within a non-extendable period of five days.

3. They will be exonerated between October 1, 2020 and January 31, 2021, from the payment of the business contribution to the Social Security contribution and for joint collection concepts, in the percentages and conditions indicated in the following section, the following companies:

a) Companies to which the current temporary employment regulation file is automatically extended, based on article 22 of Royal Decree-Law 8/2020, of March 17, as established in article 1.1, and that have the consideration belonging to sectors with a high coverage rate for temporary employment regulation files and a low activity recovery rate, according to sections 1 and 2 of this additional provision.

b) Companies referred to in article 3.3, which move from a temporary regulation file of use of force majeure based on the causes of article 22 of Royal Decree-Law 8/2020, of March 17, to one of causes economic, technical, organizational or production during the validity of this standard, whose activity is classified in one of the codes of the National Classification of Economic Activities –CNAE-09– provided for in the Annex of this standard at the time of its entry in force.

4. The companies indicated in the previous section will be exonerated, with respect to the workers affected by the temporary employment regulation file who restart their activity as of October 1, 2020, or who have restarted it since the entry into force of the Royal Decree-Law 18/2020, of May 12, in the terms of its article 4.2.a), and of the periods and percentages of working hours as of October 1, 2020, and with respect to workers who have their activities suspended between October 1, 2020 and January 31, 2021 and the periods and percentages of working hours affected by the suspension, in the percentages and conditions indicated below:

a) 85% of the business contribution accrued in October, November, December 2020 and January 2021, when the company had less than fifty workers or assimilated to them registered with Social Security on February 29 2020.

b) 75% of the business contribution accrued in October, November, December 2020 and January 2021, when the company had fifty or more employees or similar employees registered as of February 29, 2020. 5 The exemptions regulated in this additional provision will be incompatible with the measures regulated in article 2 of this regulation. Likewise, sections 3, 4, 5, 6 and 7 of article 2 of this royal decree-law will apply to them.